The new generation of banking customers would rather use biometric security devices than PINs and passwords for authentication, according to Visa Europe.

The payments firm found that 75% of 16 to 24-year-olds, or ‘Generation Z’, said they would have no problem using biometric security, with 69% expecting it to be faster and easier than a password or a PIN.

Jonathan Vaux, executive director at Visa Europe, said: “We have more log-ins and passwords than ever to help keep us secure online and on the high street, but for Gen Z it just feels like an unnecessary burden. Biometric authentication using fingerprint recognition or retinal scans offers an ideal solution, combining unique security and ease of use. “For banks and product providers this means two challenges. First, to continue and quicken the pace of development on biometrics to answer this demand from Generation Z. Second, to continue to evaluate the increasing range of authentication options to ensure customer convenience and security as payment increasingly becomes embedded into a range of applications.”

Nearly 35% of the people in the Generation Z age group said they had shared their PIN number with someone else, compared with only 23% of all those surveyed.

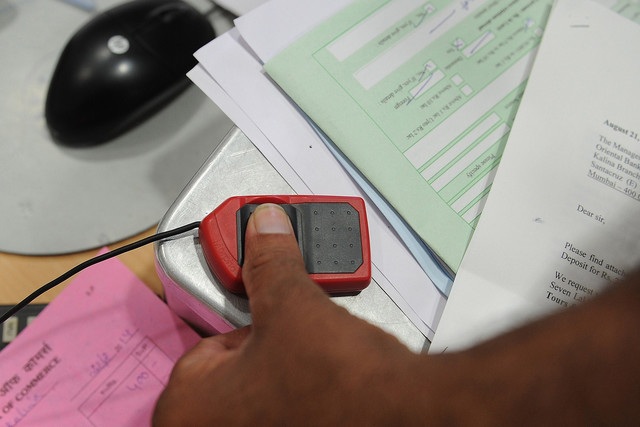

Over 20% of Generation Z have shared their online banking password with someone else, and 32% have given out their smartphone password. More than half of 16 to 24-year-olds think passwords will no longer be needed or used by the end of 2020, and will be replaced by authentication methods such as facial recognition or fingerprint and retina scanners.

Of these methods, fingerprint recognition is the most popular, with DNA samples and implanted chips coming in last. Vaux said the adoption of biometric technology is rising, as it has for mobile banking and payments, as consumers realise the benefits of the authentication.