Memoori’s 12th annual world report on the Physical Security Business estimates that the total value of physical security products at factory gate prices in 2020 was $31.7Bn, a decline of over 7% in 2019. Sales declined over all 4 quarters as a result of the Covid-19 pandemic. This has ended eleven consecutive years of growth in the industry.

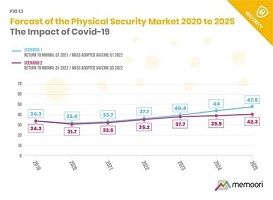

In June 2020, the World Bank published a baseline forecast envisioning a 5.2% contraction in global GDP in 2020. Against this backdrop, the Memoori report delivers a best estimate of the global market for physical security products going forward to 2025 based on two scenarios. At this time, Covid-19 has been having second spikes in Q3 / Q4 and several countries are experiencing rolling lockdowns. On this basis, Memoori researchers believe their 2nd scenario looks most feasible where global markets take around a year to return to some normality and mass global adoption of a vaccine is achieved within 18 months. Memoori suggests this scenario has a probability of 65%.

Counteracting these macroeconomic forces, the pandemic has also created demand for new solutions to help control the spread of the virus. Physical security products have risen to the challenge, helping to implement social distancing protocols through existing access and video systems with AI-powered analytics. Thermal cameras have also been deployed to measure people’s temperature, with demand being strong. However their usefulness has been questioned, with the World Health Organisation saying that on its own temperature screening “may not be very effective”.

Despite all this Memoori analysts are still confident of the industry’s robustness and prospects for growth over the medium to long term. Market drivers like the threat from terrorism and crime are unlikely to abate, whilst urbanisation and smart infrastructure will further drive demand for more and better security systems.

Above all the Covid-19 outbreak will force suppliers to radically rethink how they operate their business, in particular resilience to externalities. In parallel, there will be lessons to learn on having a more coordinated and resilient supply chain. The analysts find that the video surveillance business is too dependent on Chinese OEM’s and component manufacturers. With many of these factories closed for the first two months of 2020, it caused temporary supply chain issues.

As we move forward Post-Covid, Memoori concludes that vendors will need to investigate customer’s requirements thoroughly, particularly those businesses that have been severely damaged by Covid-19. It will be more difficult for these customers to find the budget to invest and therefore they have to be convinced of a return on their investment. ACaaS and VSaaS can provide a solution to this problem and there is evidence of significant accelerating growth in cloud services.